tax attorney vs cpa salary

The average salary for someone with a Certified Public Accountant CPA in New York NY is between 84492 and 554600 as of February 25 2022. In the tax area the lines between accountants and attorneys can be blurred.

Tax Lawyer Salary How To Discuss

Several factors may impact earning potential including a candidates work experience degree location and certification.

. What These Certifications Indicate. Tax return preparation is a time consuming process - especially when tax situation is complex and may require multiple drafts to achieve the optimal result. The average CPA salary in the US is 62410 but it also varies depending on your years of experience firm size and industry.

For many non-legal and non-financial people this distinction may not immediately mean much. This results in outstanding results and an affordable cost. Two common programs are the CPA and CFP certifications.

Conversely if a dual-licensed Attorney-CPA decides to continue an accounting career he has a distinct advantage over most CPAs due to his familiarity with the. Some tax clients may prefer a more versatile approach to the tax-filing process rather than the more specific one and vice-versa. According to the Illinois CPA Society the average hourly rate charged by a CPA is 229 an hour.

Although preparation of tax documents is mostly a CPAs focus tax lawyers often work side-by-side with CPAs to prepare tax documents. Tax Attorney Vs. Additionally some employers may offer.

A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro. A tax attorney is the best fit for negotiating tax settlements audits and other complex issues with the IRS. First tax lawyers are required to pass the bar exam in their state and maintain certification as a licensed.

Only a Tax Attorney can tell you ALL your options you qualify for including tax bankruptcy. Or tax preparer CAN be forced to testify against you in a criminal trial. The use of a tax accountant will also usually ensure that your internal accounting practices are valid and that the information contained therein is complete.

Although tax attorneys must typically complete law school and pass a state bar exam no minimum educational requirements exist for enrolled agents. CPAs usually work with an accounting firm but the type of clients and the exact services they provide vary. However EAs tend to lack the broad financial knowledge that CPAs have.

A tax attorney before and above all else is an attorney. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often confusing universe of taxes. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

Honestly tax lawyer is an entirely different path from a cpa. A CPA-attorney when asked what he does for a living replies that he practices tax. Thats the best part about becoming a CPA.

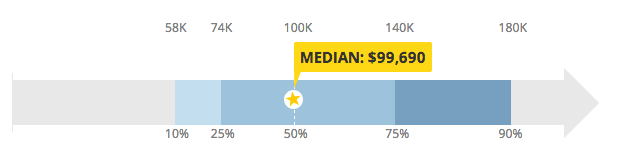

Choose a tax lawyer when receiving notices of debt. In contrast late career more than 20 years experience CPAs earn an average of 98000 per yeara stark increase. Early career one to four years in the field CPAs earn an average of 60000 per year.

If you need representation in a tax defense case trust. With four to seven years of experience the range is 148911 to 197523 with an average of 185967. Salary ranges can vary widely depending on the actual position requiring a Certified Public Accountant CPA that you are looking for.

Its best to call a tax attorney first. Attorneys have specific negotiation research and advocacy training and experience that allow them to achieve maximum. Client representation during an IRS audit.

866 303-9595 or 845. Entry-level tax attorney job salary ranges from 77735 to 105498. Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies.

Individuals with this certification typically work with matters of accounting and taxes. The average salary of a tax attorney is 120910 per year according to the BLS. WARNING Your CPA.

Tax lawyers hourly rates are too high to justify that. CPAs might have more expertise on the financial side of tax prep while an attorney can provide legal advice in the face of adversity or possible problems. CPAs may charge a flat rate for tax.

According to PayScale a tax attorneys salary starts around 80000 per year. Work with CPAs to prepare tax documents. Dont take the risk of hiring a certified public accountant for detailed tax questions.

The ceiling for cpa is much lower and compensation reflects that. Unlike CPAs EAs expertise is limited to tax matters making them extremely well-versed in their specialty. Not only do you get more career opportunities in financial services and respect from your colleagues.

With two to four years of experience the tax attorney salary ranges from 107996 to 146664 with an average salary of 135585. This is understandable according to James Mahon a shareholder in the Tax and Litigation practice groups of law firm Becker Poliakoff. The IRS requires enrolled agents to take at least 72 hours of continuing education courses every three years to maintain their knowledge of current tax laws and issues.

An attorney CPA or an enrolled agent always may assist its clients in the preparation of electronic BSA forms for BSA E-Filing including the FBAR. CPAs generally charge less for services than tax attorneys. One clear distinction between a certified public accountant CPA and a tax attorney is right there in the name.

Both CPAs and tax lawyers can help with tax planning financial decisions and minimizing tax penalties. With more online real-time compensation data than any other. You also get a pretty sweet bump in your salary and compensation.

CPA stands for certified public accountant. Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning. Salaries in the law field range from 58220 to 208000.

According to data from PayScale the average salary for CPAs increases steadily with more experience. Unlike other tax relief companies who only have Enrolled Agents CPAs or tax attorneys TRP has all three working on the right parts of your case. Thats a long 5 years filled with busy seasons and lots of.

As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients. Consistent with FinCENs instructions that provide for approved third-party filing of the FBAR if an attorney CPA or enrolled agent has been provided documented authority Form 114a by. Tax attorneys routinely represent clients under audit by the IRS.

Although there is a difference between a tax attorney and a CPA members of both professions work on a variety of tax-related issues and their.

How Much Does A Lawyer Make Guide To Types Of Lawyers Salaries

The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond

Tax Law Salary Northeastern University Online

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Find 9 Tax Attorney Near In Fayetteville In 2022 Tax Attorney Attorneys Job Recruiters

What Can You Do With An Accounting Degree Accounting Degree Accounting Jobs Accounting

How Much Money Do Enrolled Agents Make Find Out Ea Accounting Salaries Right Here Enrolledagent Salary Accountingcareer Enrolled Agent Cpa Exam Salary

Calculating Reasonable Shareholder Salary Watson Cpa Group Business Valuation Salary Business Tax Deductions

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney

Tax Law Salary Northeastern University Online

Find 17 Tax Attorney Near In Denton In 2022 Tax Attorney Attorneys Job Recruiters

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Wage Garnishment Wage Garnishment Tax Help Tax Attorney

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

![]()

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Cpa Vs Tax Attorney What S The Difference

They Simply Cannot Bear The Burden Of Hiring A Professional Like A Cpa Or An Ea The Level Of Support You C Income Tax Preparation Income Tax Income Tax Return